Just Announced

1 LAKH + CASE LAWS

3000 + GST FAQ's

50k + CASE ANALYSIS

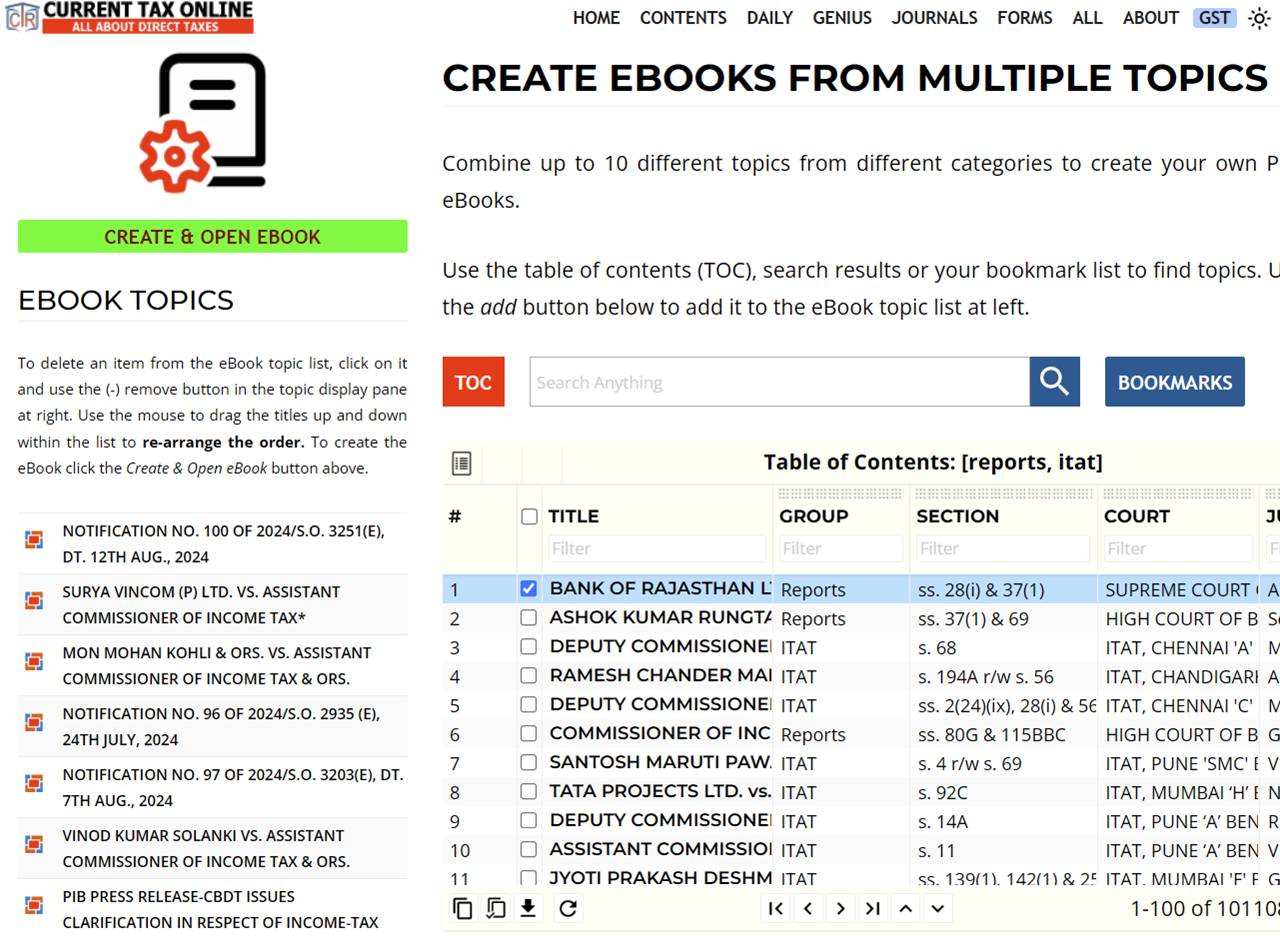

E-BOOK

Our new e-book feature empowers you to curate a tailored collection of essential judgments, topics, and FAQs directly from our extensive database.

Why Choose Our E-Book Feature?

Create a personalized e-book by handpicking content from a vast array of topics and judgments tailored to your legal needs. Utilize our advanced Genius Search to find specific information quickly, and bookmark your favorites for easy access. This feature streamlines your daily tasks, ensuring vital information is always at your fingertips, and offers flexible PDF download options for both digital and printed formats. Experience the convenience of having a curated legal resource designed just for you!

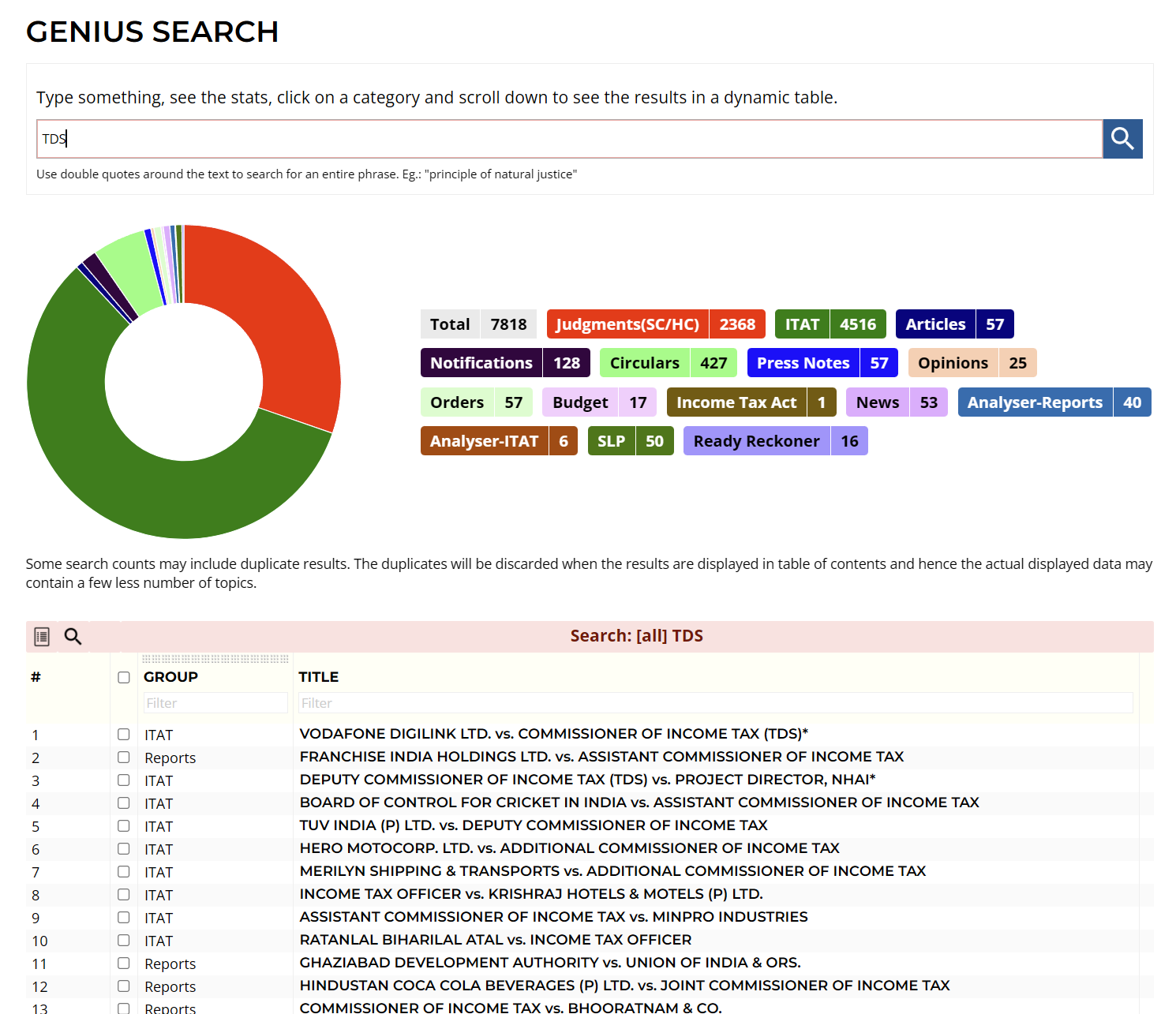

UNLOCK THE POWER OF SMART TAX SEARCH

Enter any keyword or phrase, and Genius Search will fetch relevant results from our extensive database of Income Tax and GST judgments, circulars, notifications, Act, and articles.

Experience the difference of a search tool crafted specifically for tax experts like you.

Our Genius Search empowers you to navigate complex tax landscapes with ease, saving you valuable time and ensuring you stay ahead in your professional endeavors.

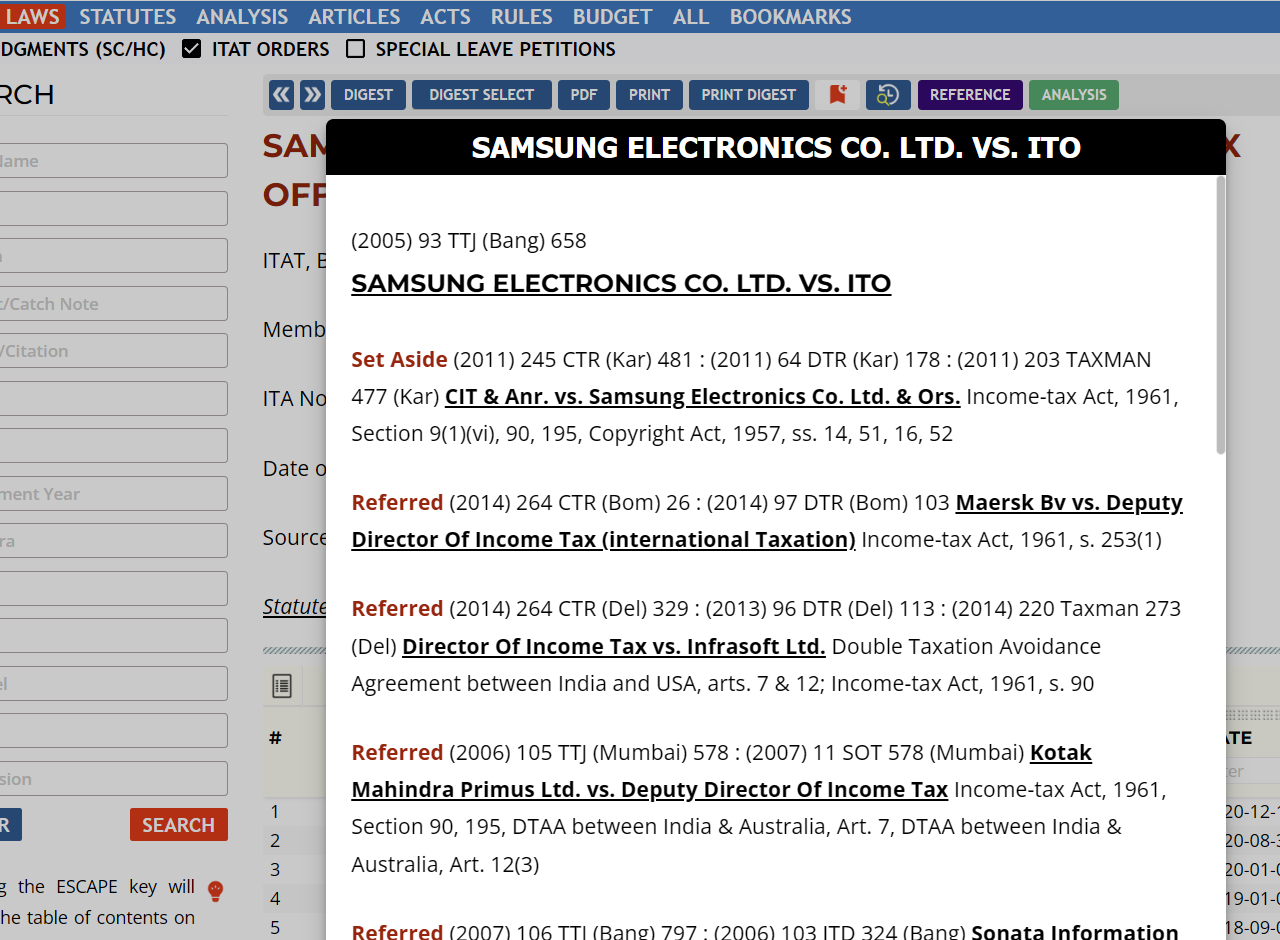

ANALYSER (HIGH COURT AND TRIBUNAL)

YOUR COMPASS IN LEGAL PRECEDENTS

Dive deep into the intricacies of legal treatment with our innovative ANALYSER feature! Here, we meticulously scrutinize how pivotal decisions are handled in subsequent judgments, categorizing them under essential headings like AFFIRMED, FOLLOWED, DISSENTED, DISTINGUISHED, REFERRED, RELIED ON and more. This comprehensive analysis not only enhances your understanding but also equips you with the insights needed to navigate the evolving landscape of legal precedents effectively. Stay informed and empowered with our cutting-edge legal analysis tool!

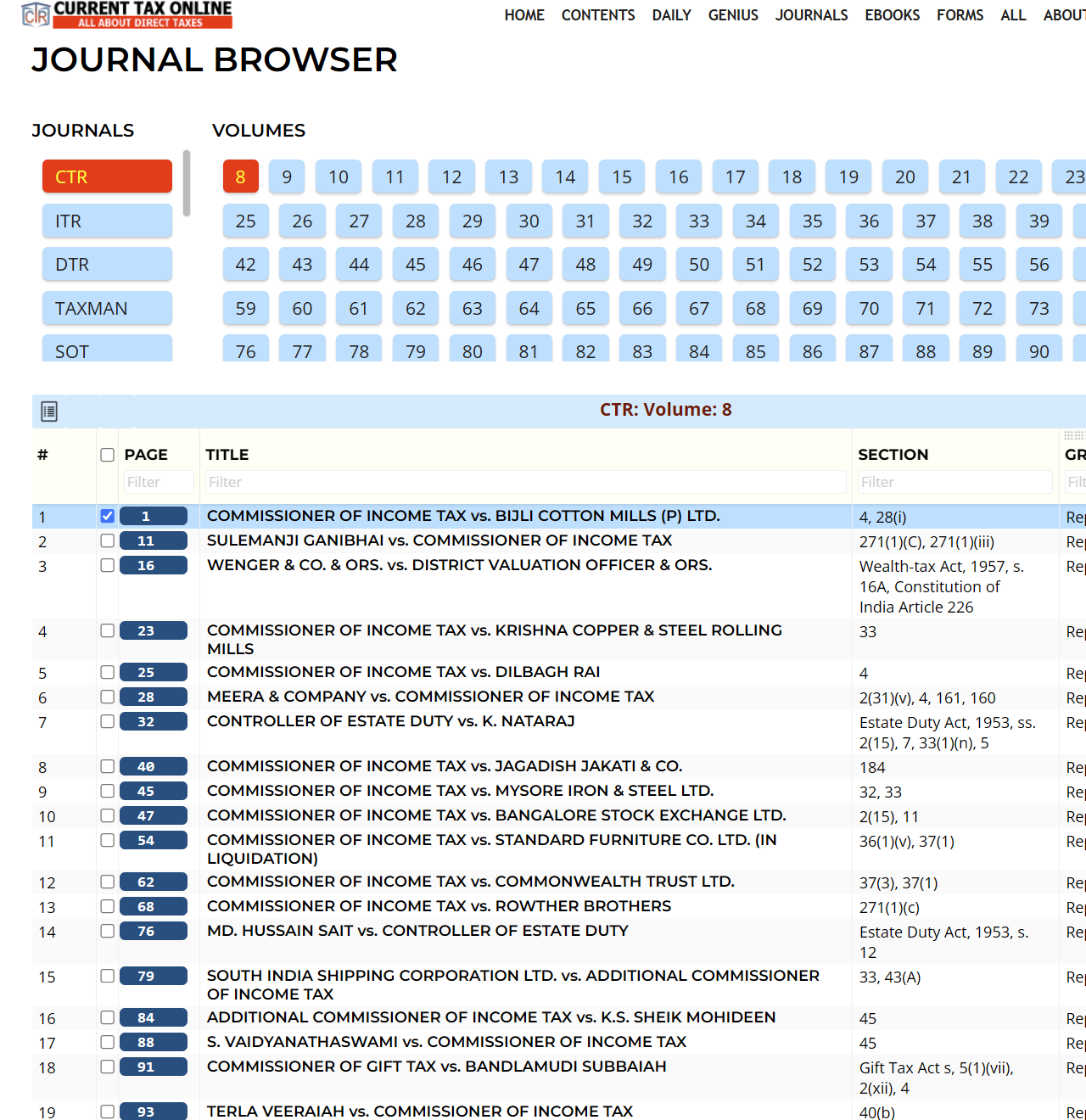

JOURNAL COVERAGE

Streamline Your Tax Research by Exploring All INCOME TAX JOURNALS Now!

Experience the convenience of having all the resources you require at your fingertips, making your tax research not only easier but also more efficient. Our extensive collection of journals, includes Current Tax Reporter(CTR), Direct Taxes Reporter(DTR), Selected Orders of ITAT, All India Tax Tribunal Judgments (TTJ) and other journals in India thereby enabling you to quickly browse a wide array of resources, ensuring you remain informed and up-to-date. Our platform allows for seamless navigation through essential legal insights, expert articles, and critical updates, helping you streamline your workload and save valuable time.

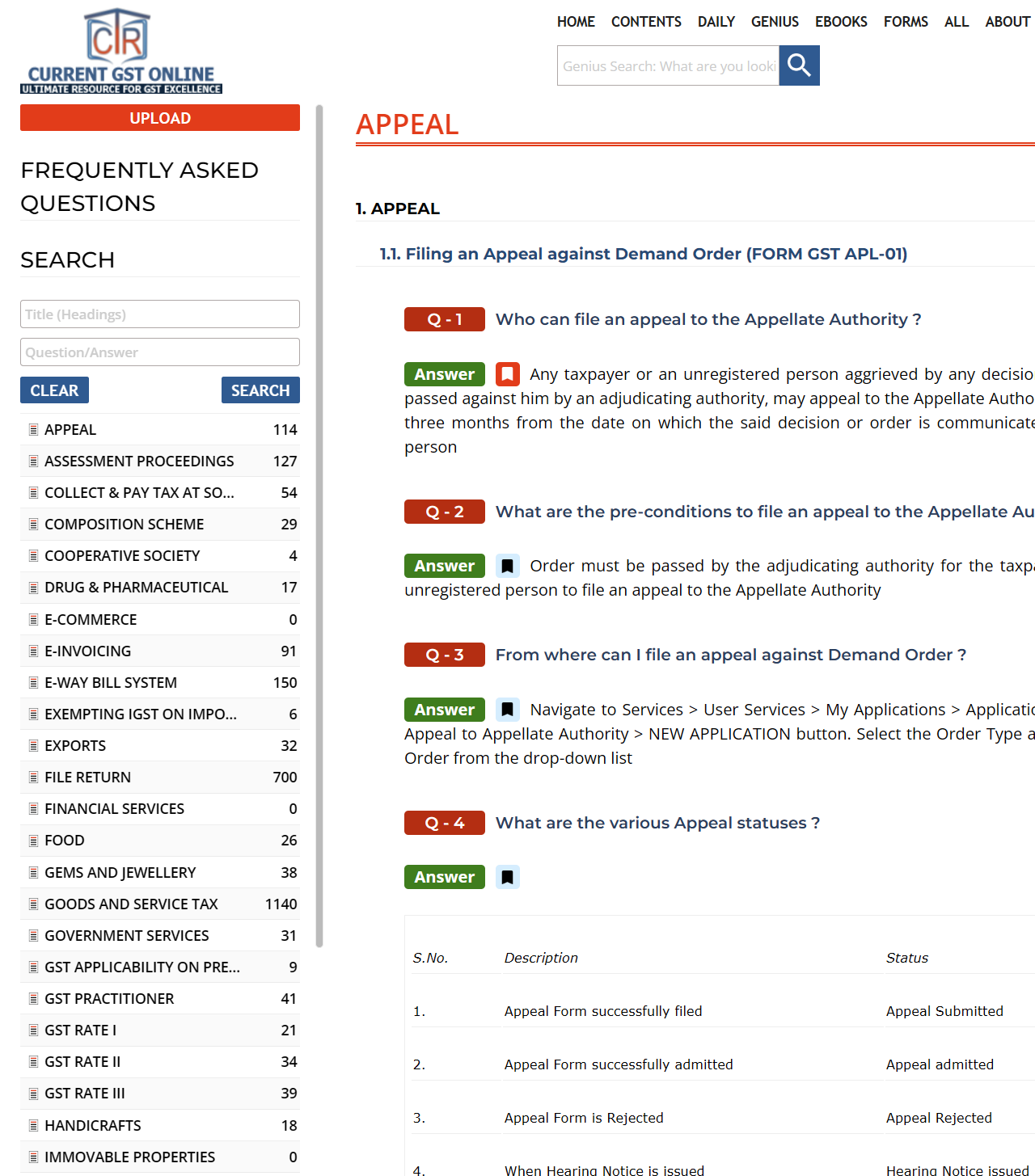

GST FAQ'S

NAVIGATE LIKE A PRO!

Managing GST can often feel overwhelming, which is why we have curated a comprehensive GST FAQ section with over 3,000 frequently asked questions designed to address the most common issues taxpayers face. This extensive resource provides quick answers, allowing you to find immediate solutions to your GST-related queries and save valuable time. It also offers in-depth insights into GST laws, compliance requirements, and best practices, empowering you to make informed decisions.

Additionally, you can bookmark FAQs and add them to your personal e-book, allowing you to easily reference important information whenever you need it.

Explore our GST FAQ section today and take the stress out of your GST compliance journey!

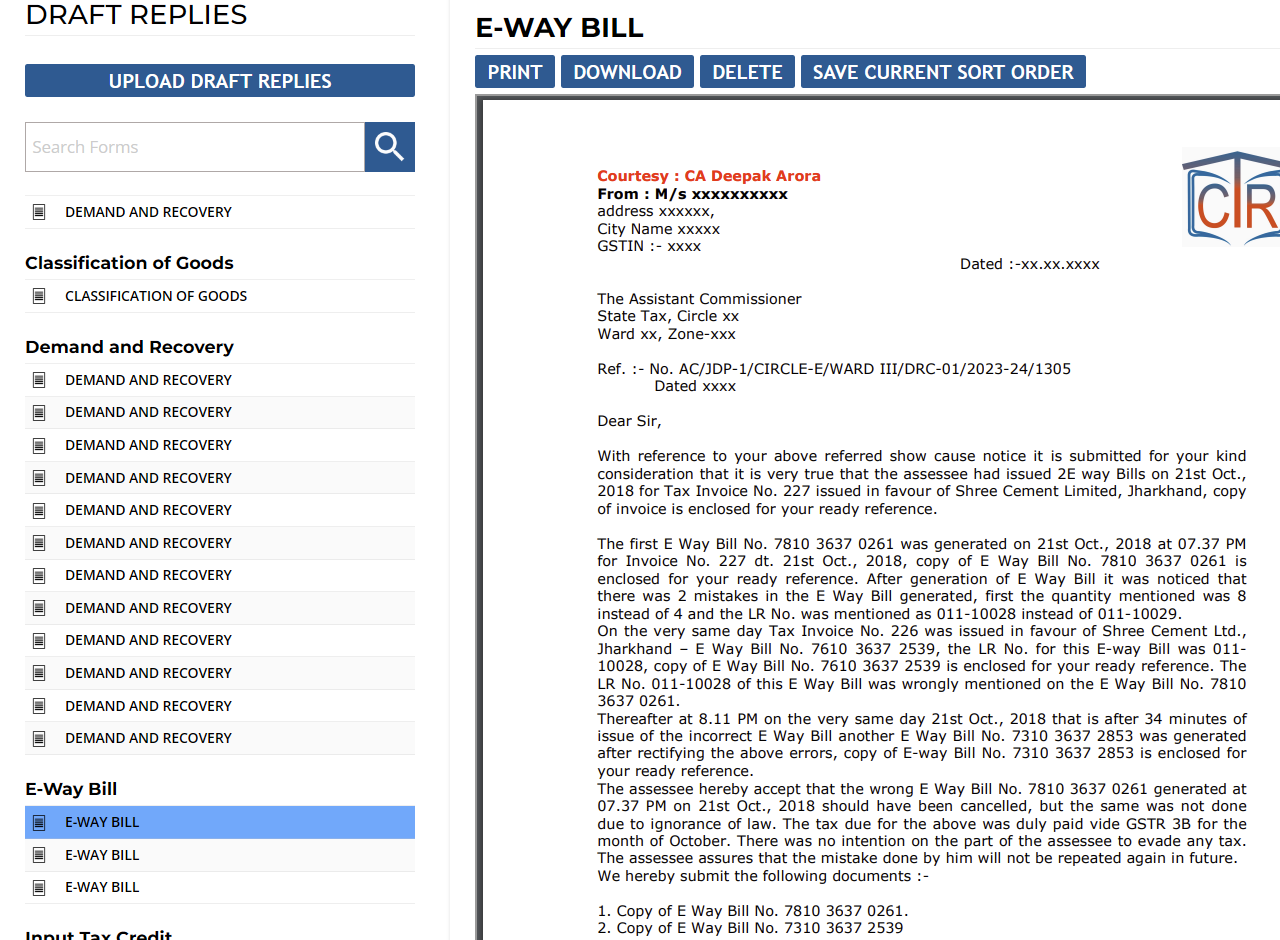

DRAFT REPLY (GST)

MASTER YOUR GST NOTICES WITH EXPERT DRAFT REPLIES

At Current Tax Online, we recognize the complexities and challenges taxpayers encounter with GST compliance. To assist our valued subscribers, we offer a comprehensive library of draft replies for various types of GST notices.

Our user-friendly templates are designed to simplify the response process, ensuring that you can address notices promptly and accurately. Whether you receive a show cause notice, scrutiny notice, or demand notice, our solutions help ease your compliance journey, reducing the risk of penalties and legal complications.

Explore our resources today and navigate GST notices with confidence!

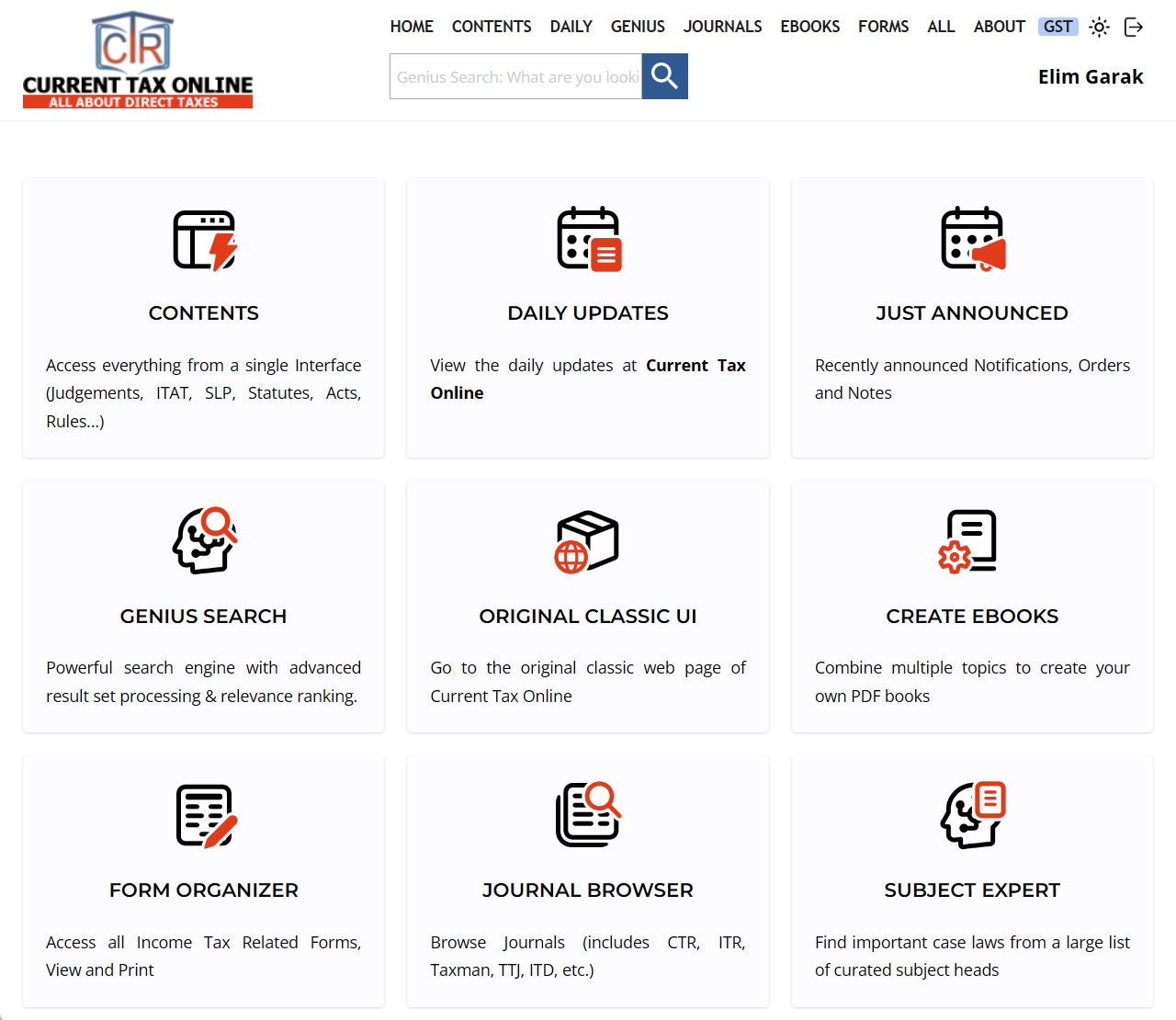

Latest at Current Tax Online

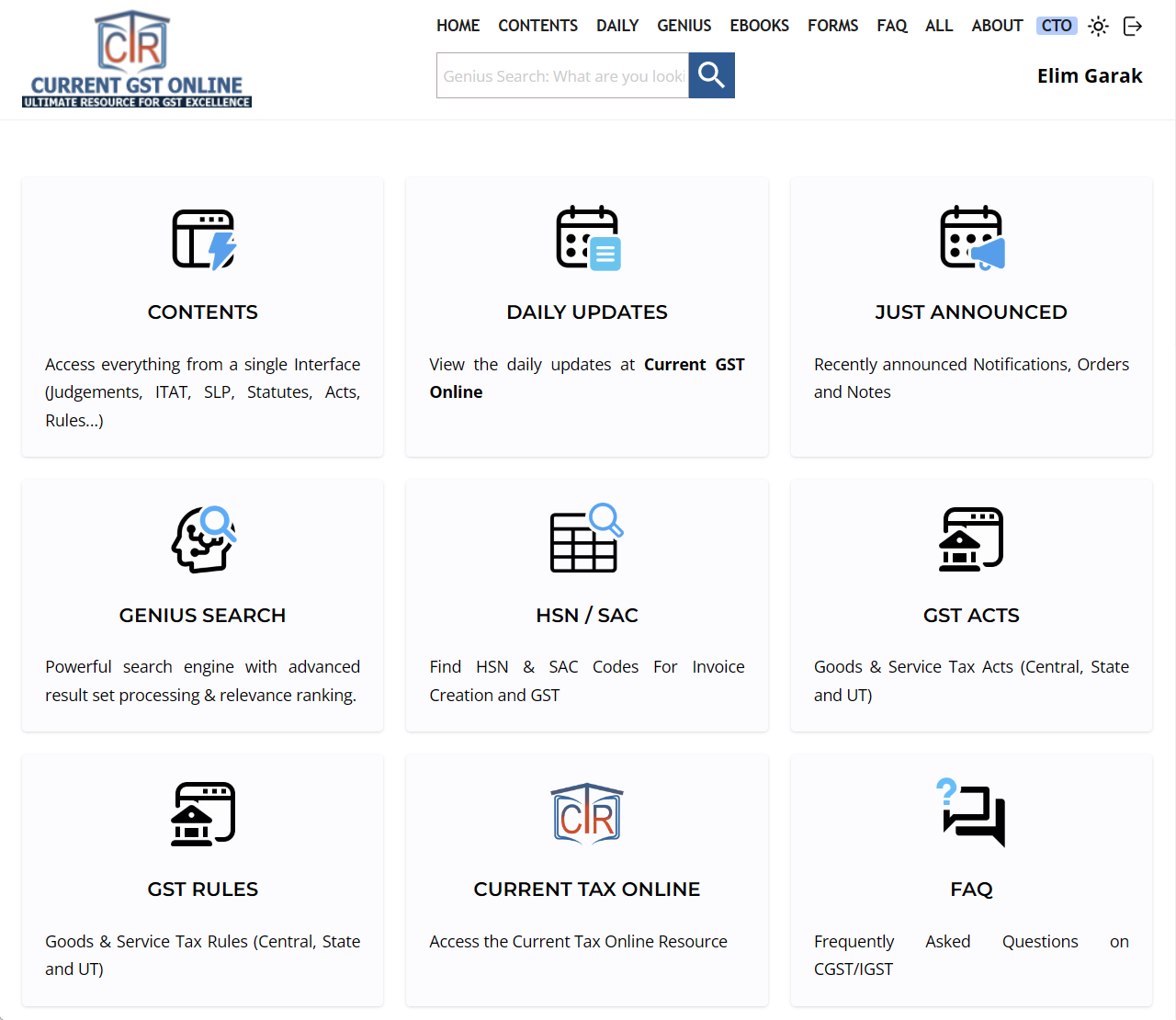

Latest at Current GST Online

PRINT MEDIA JOURNALS

CURRENT TAX REPORTER

SINCE 1972

ALL INDIA TAX TRIBUNAL JUDGEMENTS

SINCE 1976

DTR E-JOURNAL

Windows & Mac Software to access our Journals from your desktop.